WASHINGTON — The Paycheck Protection Program officially ran out of money on Thursday, closing the door for now on new applicants and leaving many small business owners hanging regarding the status of their loan applications.

- Lawmakers deadlocked over how to allocate more funding

- Senate adjourned Thursday with no agreement

- More coronavirus stories

As of early this week, over 52,000 loans had been approved in the state of Florida. However, many owners are still in the dark about whether their applications have been approved.

“I just feel completely abandoned,” said Bill Nobles, owner of Affordable Contracting Inc. in Palm Harbor.

Nobles applied for multiple loans through both Chase and the Small Business Administration (SBA) the day the applications became available. However, he still has no clarity regarding if any of his applications have been approved, even after waiting on hold for hours and trying to consult with bank representatives at multiple branch locations.

“A person from Chase stated that the PPP loan, any kind of information about the status, I’d have to contact the SBA," Nobles explained. "I called SBA and they said, that’s incorrect, the PPP loans are strictly through your bank."

After learning the small business rescue fund set up by Congress exhausted its funding on Thursday, Nobles has been forced to face the unthinkable.

“I’ve completely depleted all of my funds. My stress is my employees. It’s them and their families, you know, they have kids,” he said, wiping away tears.

"Every time I call, they don't know what's going on."

Nobles is not the only small business owner getting the runaround.

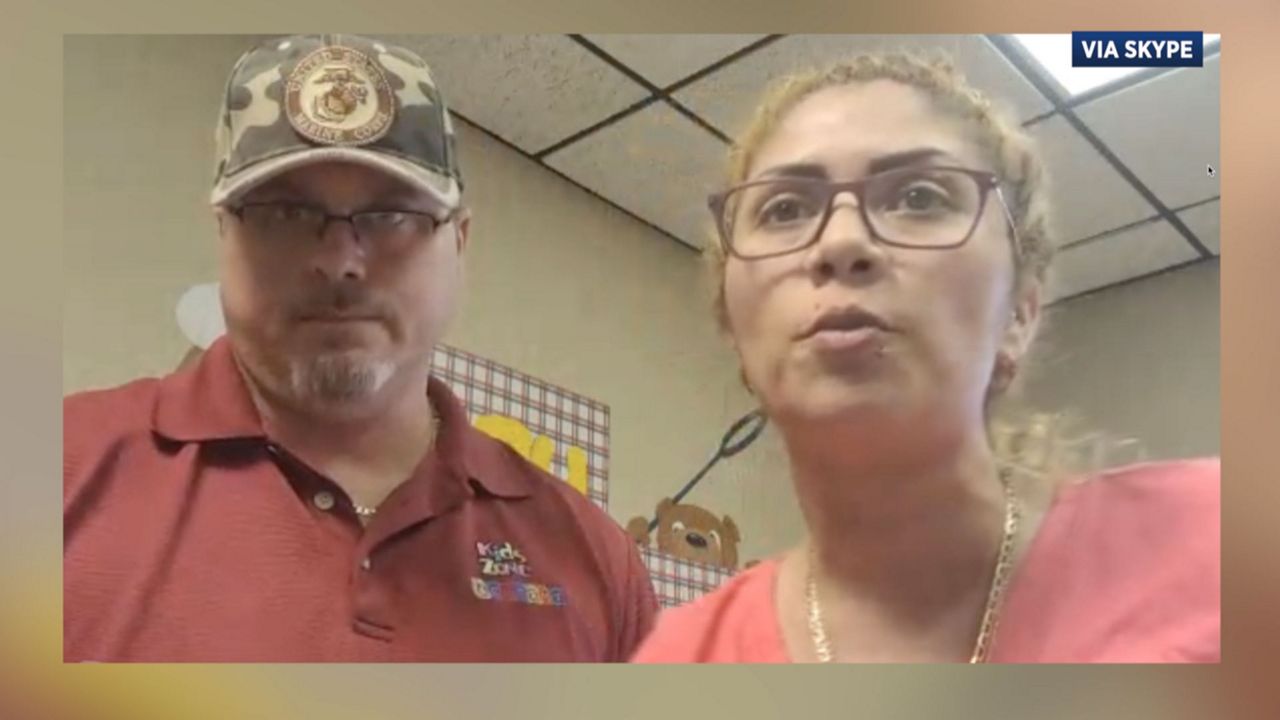

Karen and Aaron Scheeley, the owners of Kids Zone Academy in St. Petersburg, initially were denied a small business loan through Bank of America. Eventually, they were able to submit an application, but two weeks later the status of their application is still unclear.

“Every time I call, they don’t know what’s going on,” Karen Scheeley explained. “Now, it is all over the news, they say there’s no more money. Nobody else can apply. So what’s going to happen with the people that have already applied and have no answer?"

The answer to these questions are uncertain, even to lawmakers who helped craft the program.

“It depends. You’re going to have to follow up with your lending institution,” said Rep. Ross Spano (R-15th District), the only member of the Florida delegation on the Small Business Committee in the House of Representatives. “If an application has already been made, there’s still a possibility that funds were reserved back to assume there would be a need for applications in process."

No agreement on future funding for program

However, lawmakers are deadlocked over how to allocate more money for the popular loan program. Democrats continue to oppose more funding for the popular loan program without equal aid for hospitals and local governments.

“While we should help small businesses, we also need to help our health care providers who are providing the treatment and care for the people that have COVID-19,” said Rep. Stephanie Murphy (D-7th District).

As lawmakers attempt to cut a deal, small business owners are left wondering if help is really on the way.

“Basically now, we are down to maybe a month left of work,” Nobles said. “With nothing confirmed for the future, we are running out of time."

Those forced to close their businesses in the midst of the pandemic are now sending a message to lawmakers on Capitol Hill.

“We all need to put politics aside and work together during a crisis like this, work together,” Aaron Scheeley said.

The Senate adjourned Thursday without any kind of agreement, leaving the fight for small business funding to extend into next week.